-

Blog

- Reading time 2 min

Customer service: Innovations to simplify policies and insurance

As far as customer service is concerned, in 2021, Swiss Reinsurance Company estimated that approximately 340 million insurance policies were issued in Latin America. This is impressive, considering the amount of pre- or post-sales operations involved.

In this context, some of the reasons why users need to communicate proactively with insurers include:

- View outstanding balances, maturity dates and hedges

- Make premium payments for the purchase or renewal of policies.

- Report claims and request remote or on-site assistance

- Modify personal data, contact details or the insured property

- Manage compensation and obtain information on its status

It is therefore extremely important that service providers, especially their customer service departments, focus on providing customer support that can be addressed through different channels, but above all, that provides a seamless omnichannel experience for users.

With this in mind, since the end of last year and the beginning of this year, Meta has provided several innovations that allow companies to facilitate these operations, making human capacity and digital automations more efficient. This time, we’ll take a look at some of them:

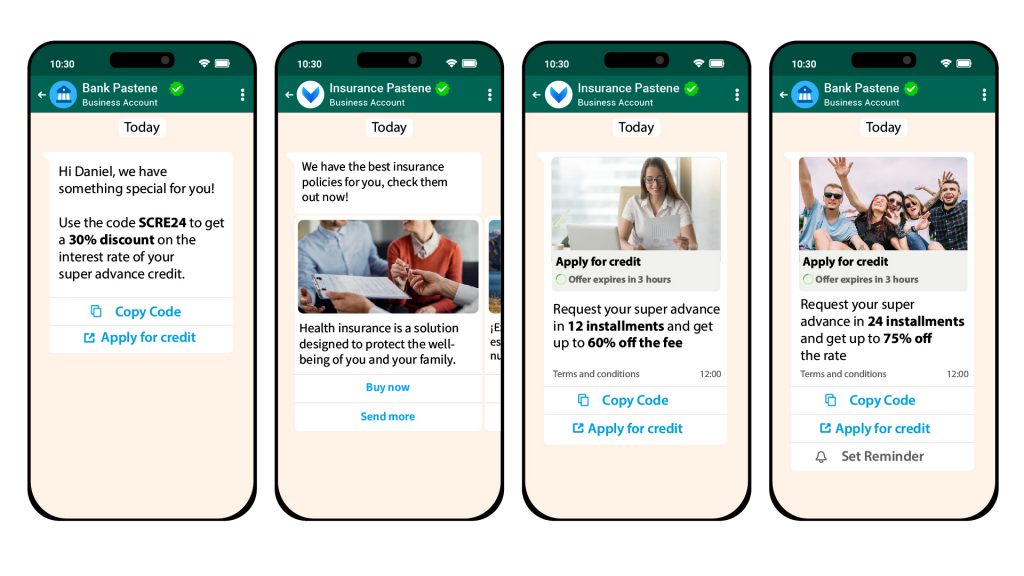

Customer service: Incorporating new interactive messaging formats

These messages can be used for promotional (marketing) and support (utility) actions, and are an excellent tool for promoting certain processes, such as: detailing the coverage of the policy, offering a discount to users who advance certain payments or simply inviting them to obtain a product for a limited time, thus improving customer service.

In addition, these messages are enriched with multimedia content, with the following formats available: coupon, carousel, countdown and reminders. Each one has a specific benefit and can even be combined and made available for implementation by the bank or insurance company at any time, from our agent service solutions (Social CX) or mass messaging (Reach & Engage).

Automating the collection of information for the delivery of insurance policies in customer service

This is a case we’ve seen before, but it remains relevant due to its high functionality.

This involves incorporating one or more “Flows”, native forms in WhatsApp, from which the user can enter important information without leaving the environment. But why is this so important? Because by keeping the customer in the same application, it significantly reduces the process abandonment rate, allowing the company to obtain up to 2.5 times more conversions.

Another interesting point is that, in this same flow, the system not only allows the user to enter information in text format or by multiple selection, but it is also possible to attach documentation in other formats, such as PDF, PNG, JPG or others, as required.

Would you like to implement these solutions or other tools in your insurance campaigns or policies? Contact us now at info@onemarketer.net or directly using the form below and we’ll be happy to help you increase your conversion.